does irs track cash app

Tax season is well underway but its never too late to get a. When it comes to cash deposits being reported to the IRS 10000 is the magic number.

Everything To Know About Venmo Cash App And Zelle Money

If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS.

. Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report cash app transactions to the feds. Fact or Fiction. The Short Answer.

Certain Cash App accounts will receive tax forms for the 2021 tax year. A basic Cash App account has a weekly 250 sending limit and a monthly 1000 receiving limit. The IRS probably already knows about many of your financial accounts and the IRS can get information on how much is there.

Under President Joe Bidens American Rescue Plan Act a new rule will empower the IRS to scrutinize cash transactions over 600. The IRS is tracking payments over 600 on Zelle Cash App Paypal and Venmo. This is far below the previous threshold of.

If you are someone who utilizes the convenience of receiving money. Today many businesses are accepting payments from all three of these digital payment platforms. As part of the 2021.

If you go through a verification process your account can be upgraded to a send limit of. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Whenever you deposit cash payments from a customer totaling 10000 the bank.

In recent years Cash App has certainly caught on to the rising popularity of crypto and took a small step forward by introducing support for Bitcoin on the platform. Does the Government Track Cash App. Thats because the IRS will be keeping a watchful eye on cash app transactions for small businesses.

The American Rescue Plan Act passed by Congress on March 11 includes a new rule that applies to business transactions over 600 which are often paid through cash apps. Cash App Support Tax Reporting for Cash App. If youre a business owner and you use Cash App to make purchases you may be wondering how you can be sure that the IRS is not tracking your Cash App payments.

Who seem to believe the IRS will be tracking. As part of the American Rescue Plan Act cash apps will now report. As a result the IRS has implemented rules for reporting cash app.

Start keeping track of those payments you receive. You may have heard the expression Cash is King. Log in to your Cash App Dashboard on web to download your.

Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle. The IRS is Tracking Money Earned on PayPal and Cash App. Have a small business or a side hustle and get paid through Paypal Cash App Zelle or Venmo.

1 2022 users who send or receive more than 600 on cash apps must report those earnings to the IRS. One of the reasons is that the IRS cannot track cash transactions between people and that is why they do not like it and would love to. What you need to know.

Cash App Taxes Review 2022 Online Tax Software With No Fees Ever Cnet

What Bank Is Cash App And How Does It Work Gobankingrates

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Cash App Taxes 2022 Tax Year 2021 Review Pcmag

Irs Has New Ways Of Taxing Cash App Transactions

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc11 Raleigh Durham

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Cash App Taxes 2022 Tax Year 2021 Review Pcmag

Changes To Cash App Reporting Threshold Paypal Venmo More

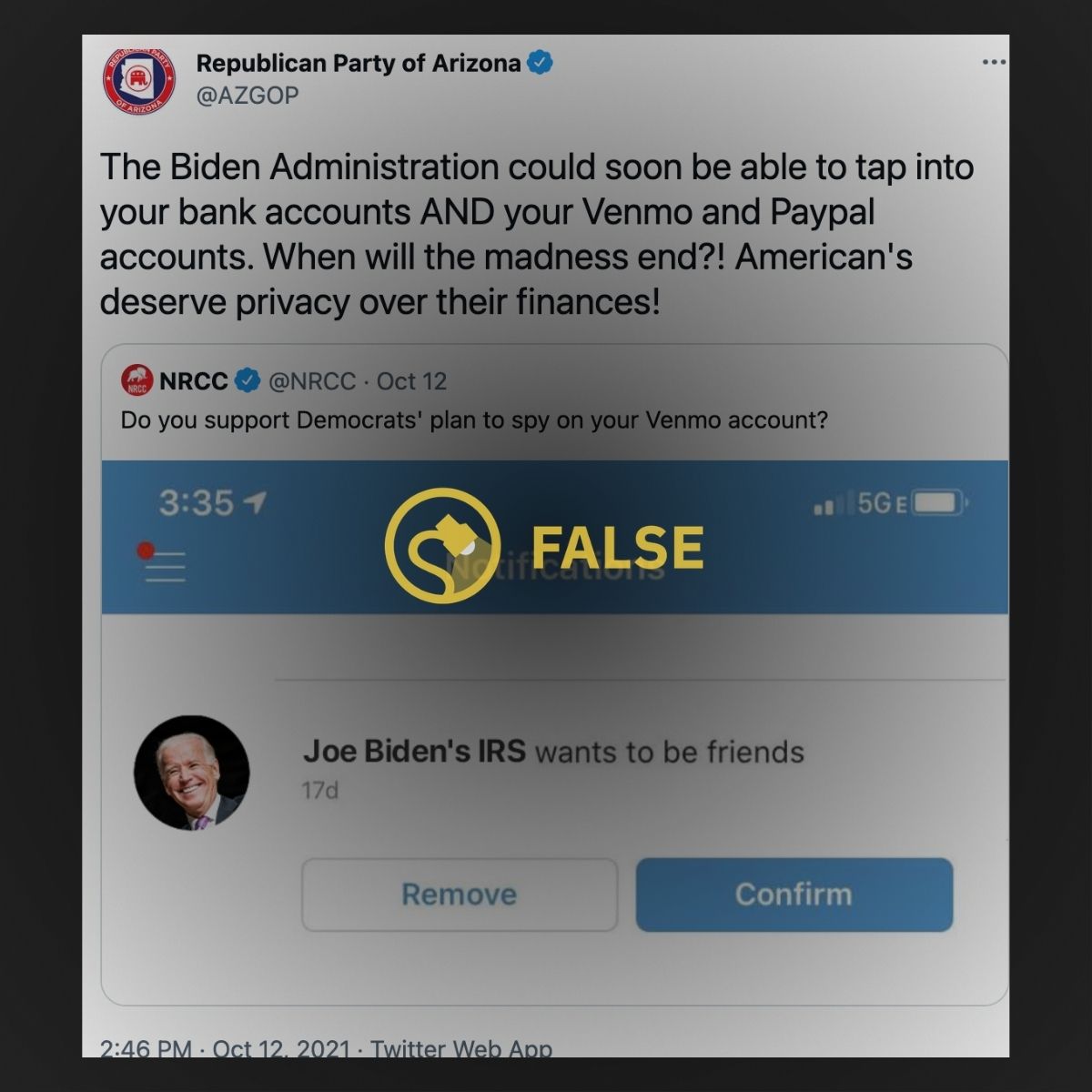

Are Biden And Dems Planning To Spy On Bank And Cash App Accounts Snopes Com

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

Cash App Personal Account Vs Business Account Youtube

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com

Cash App Taxes 100 Free Tax Filing For Federal State

Cash App Users 2 18 6am Transcript Updated 6am Deposit Date 2 24 Received Refund 8 Hours After Update 2 11 Pm Got Money 6 Days Early R Irs

Cash App Vs Venmo How They Compare Gobankingrates

Cash App Income Is Taxable Irs Changes Rules In 2022 Chosen Payments